Ajaib

•

2023

New feature

•

Mobile

I understand that this project is longer than my other study case. I've prepared a product showcase page just incase you want to see highlights only of this projects

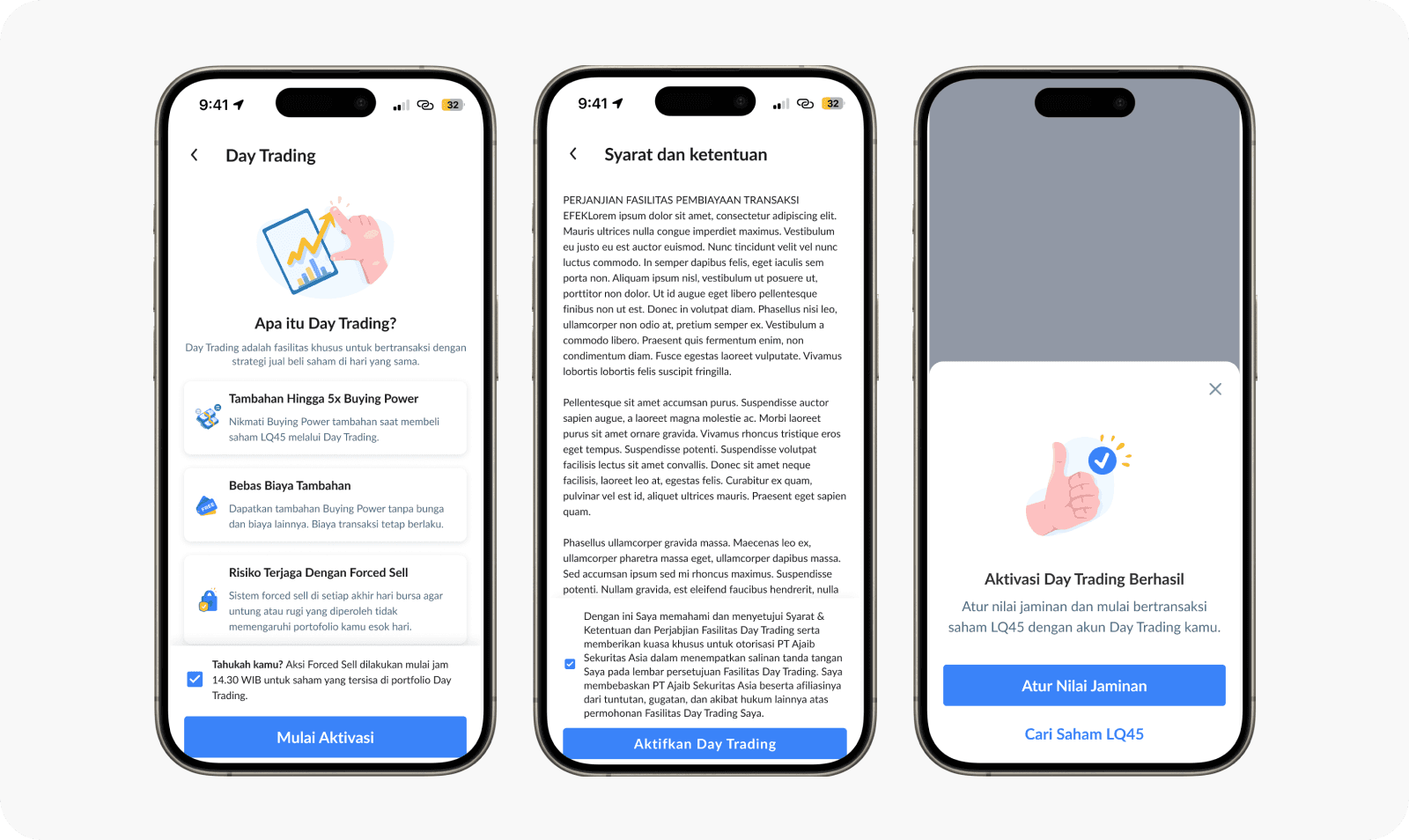

Initial Investment: You deposit a certain amount of money into your brokerage account. This is your margin.

Borrowing Funds: Based on the margin you have, the brokerage lends you additional money.

Buying Stocks: You use the combined amount (your money + borrowed money) to buy stocks.

Repaying the Loan: Eventually, you need to repay the borrowed amount, plus any interest or fees charged by the brokerage.

Objectives

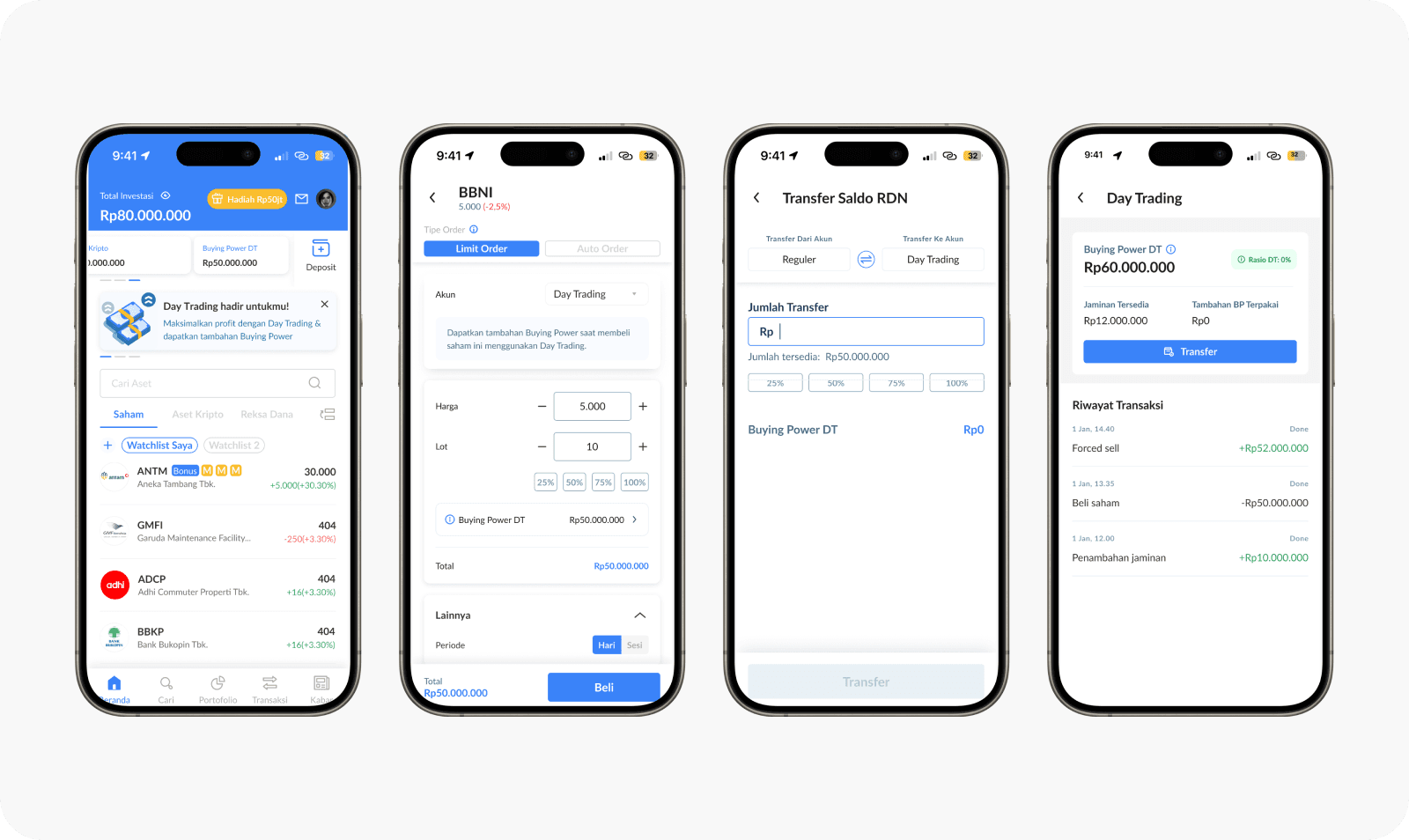

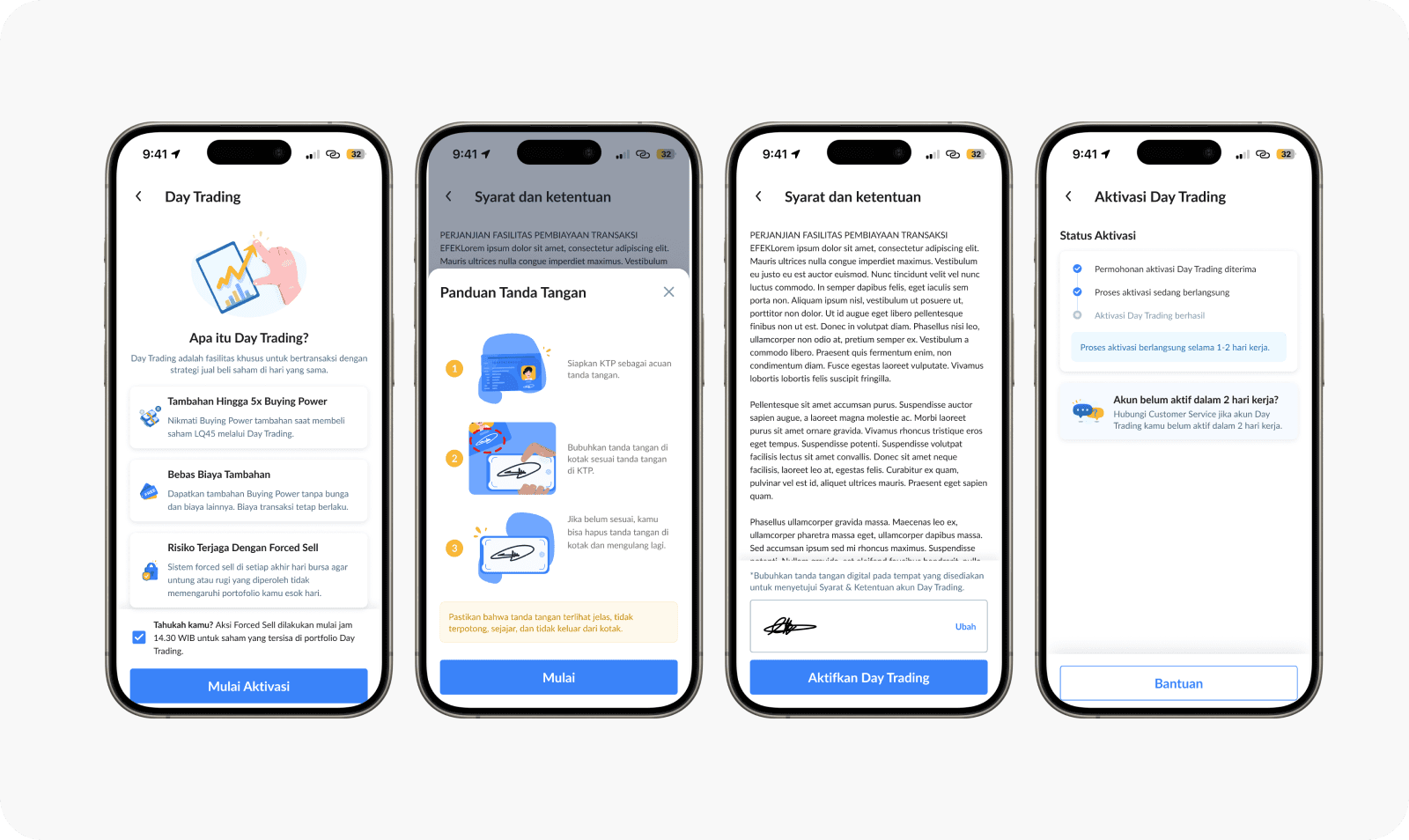

They want to use this feature but need all the help from the broker to educate them on which stocks are good for trading (High risk, high return).

Users want to have a safety net for their risk management.

They want to fully understand any side effects of this feature.

Is this a loan? I don't want to use a loan to trade.

Why do we need to force-sell our stock at the end of the day? I want to hold it longer.

Does this mean we can also get a bigger loss on this trade?

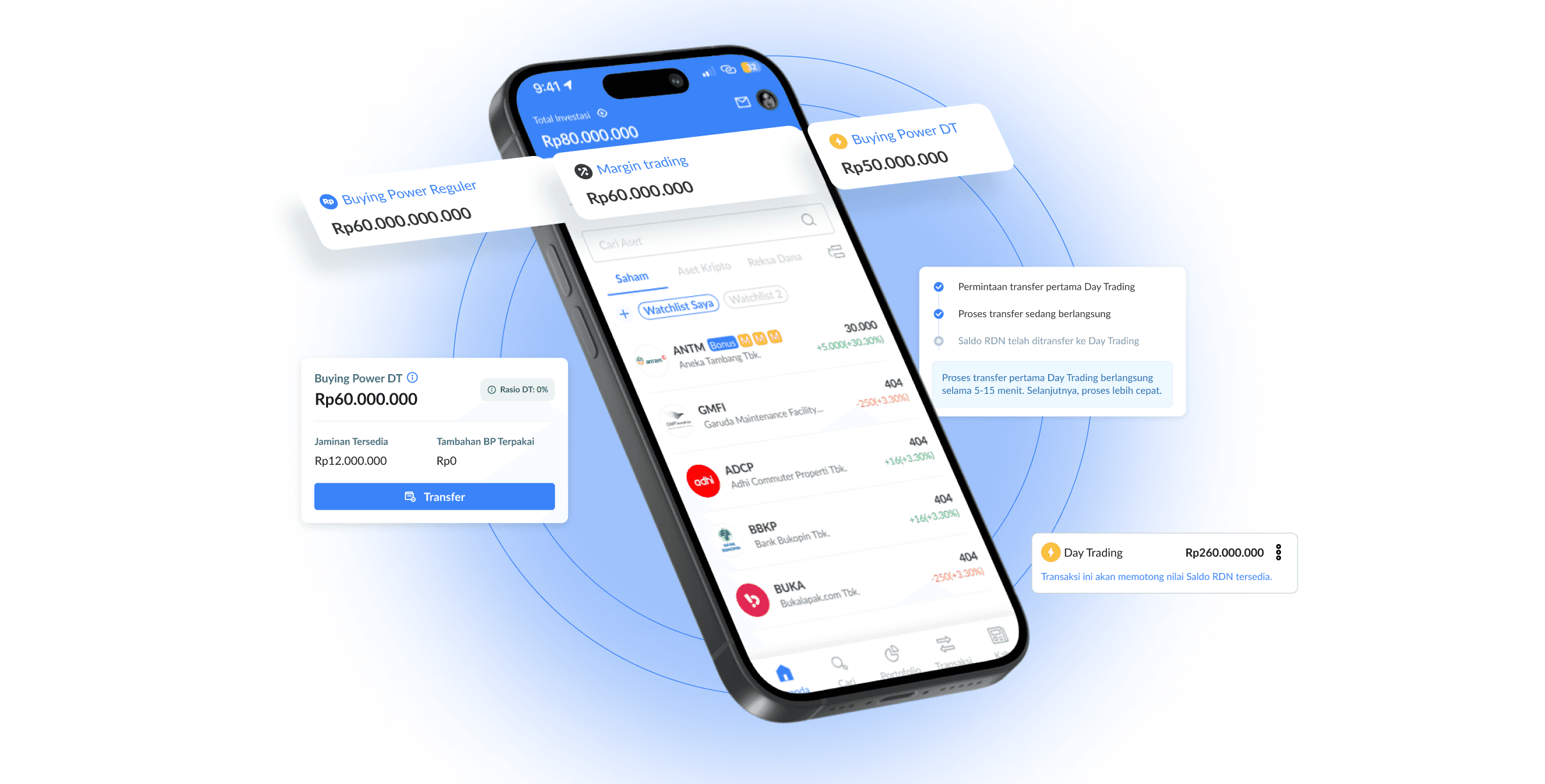

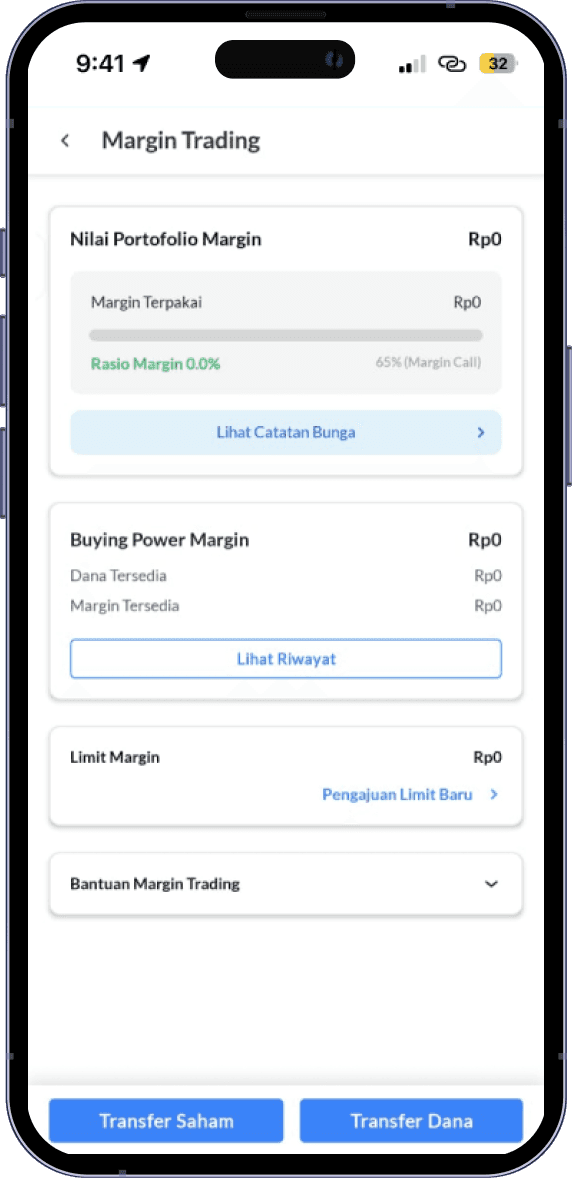

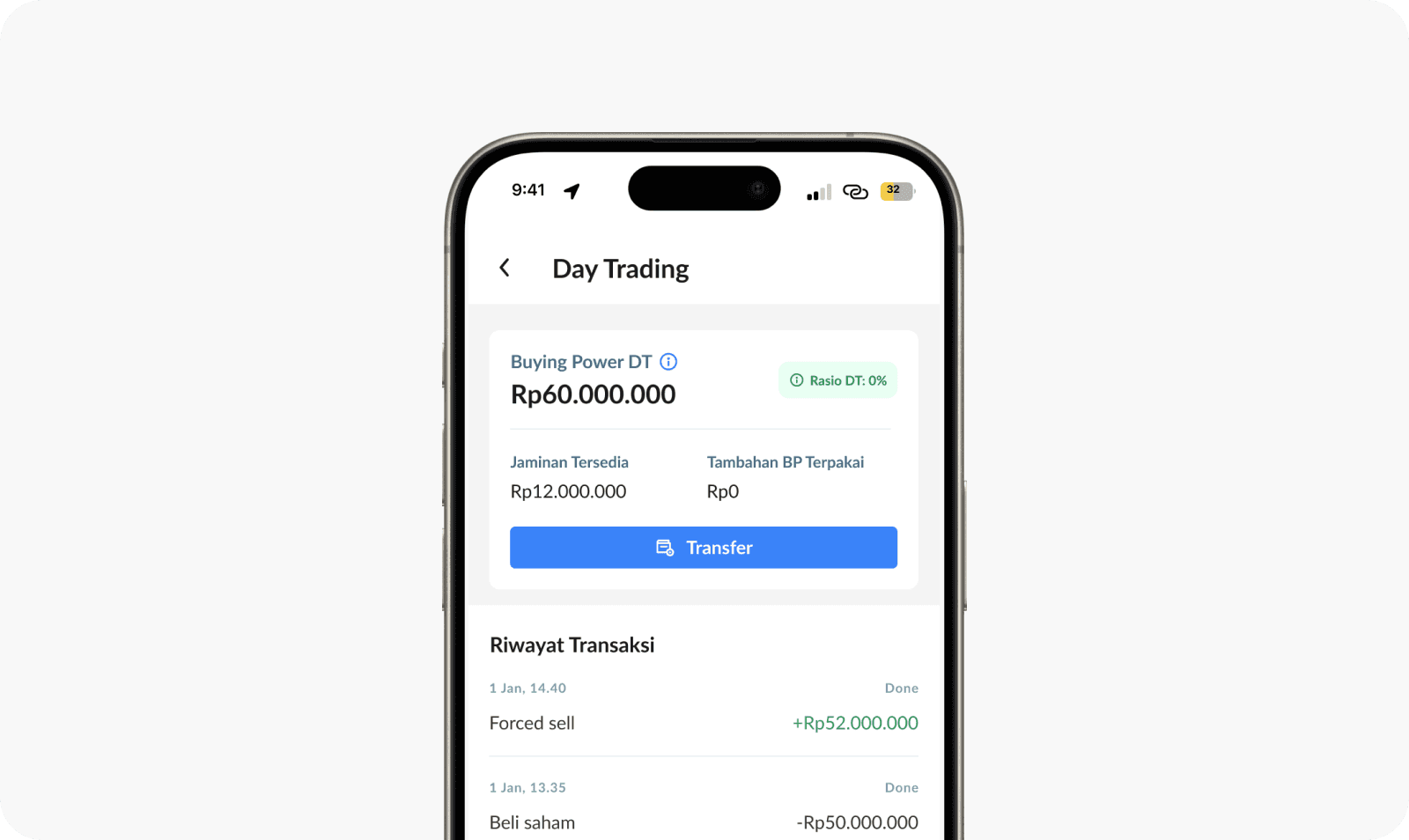

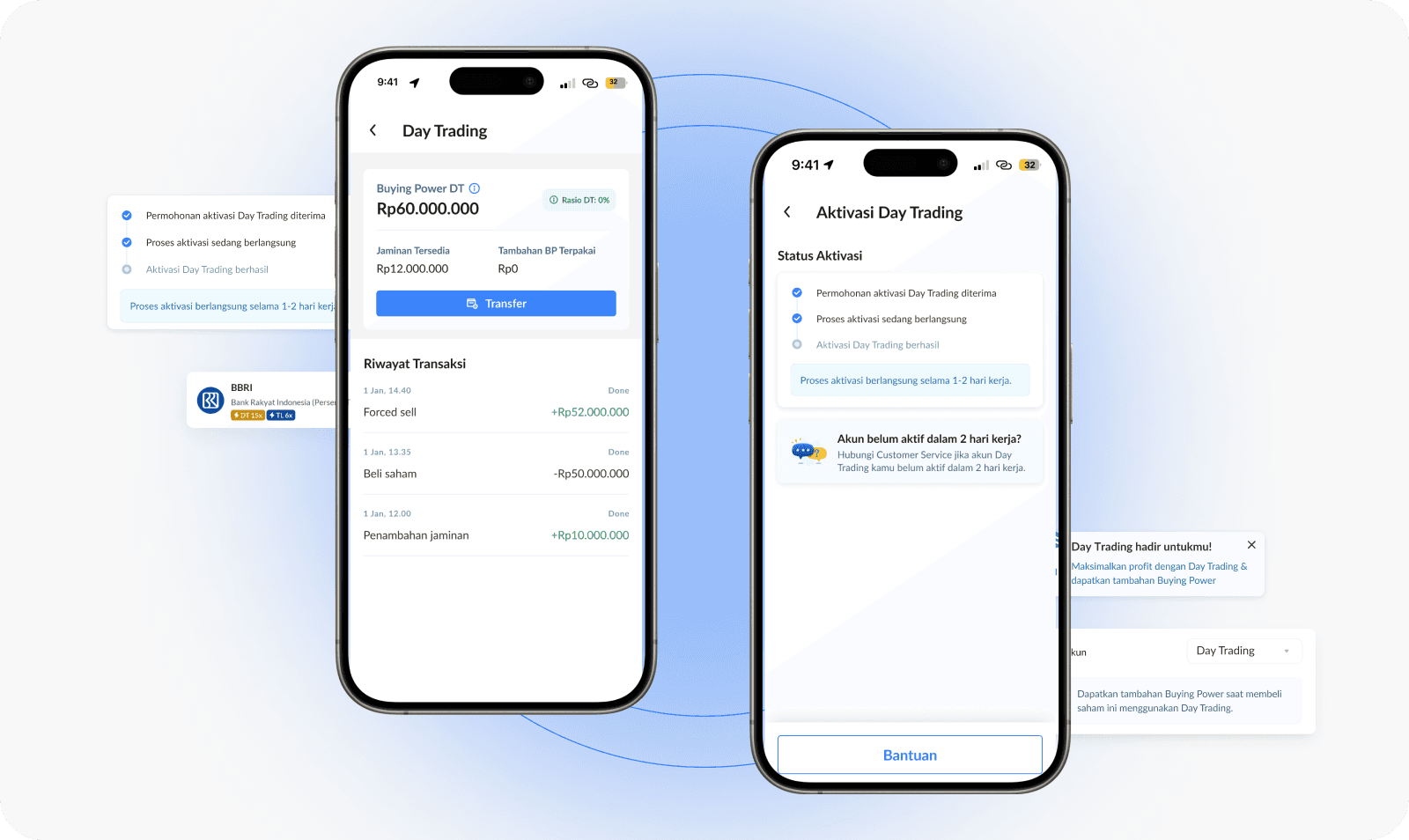

Buying Power DT

Rp60.000.000

Rasio DT: 0%

Jaminan Tersedia

Rp12.000.000

Tambahan BP Terpakai

Rp0

Transfer

Buying Power DT

Rp20.000.000

Rasio DT: 60%

Jaminan Tersedia

Rp12.000.000

Tambahan BP Terpakai

Rp40.000.000

Transfer

Buying Power DT

Rp7.000.000

Rasio DT: 75,00%

Jaminan Tersedia

Rp7.000.000

Tambahan BP Terpakai

Rp55.000.000

Transfer

"Can we have this feature on more volatile stocks?"

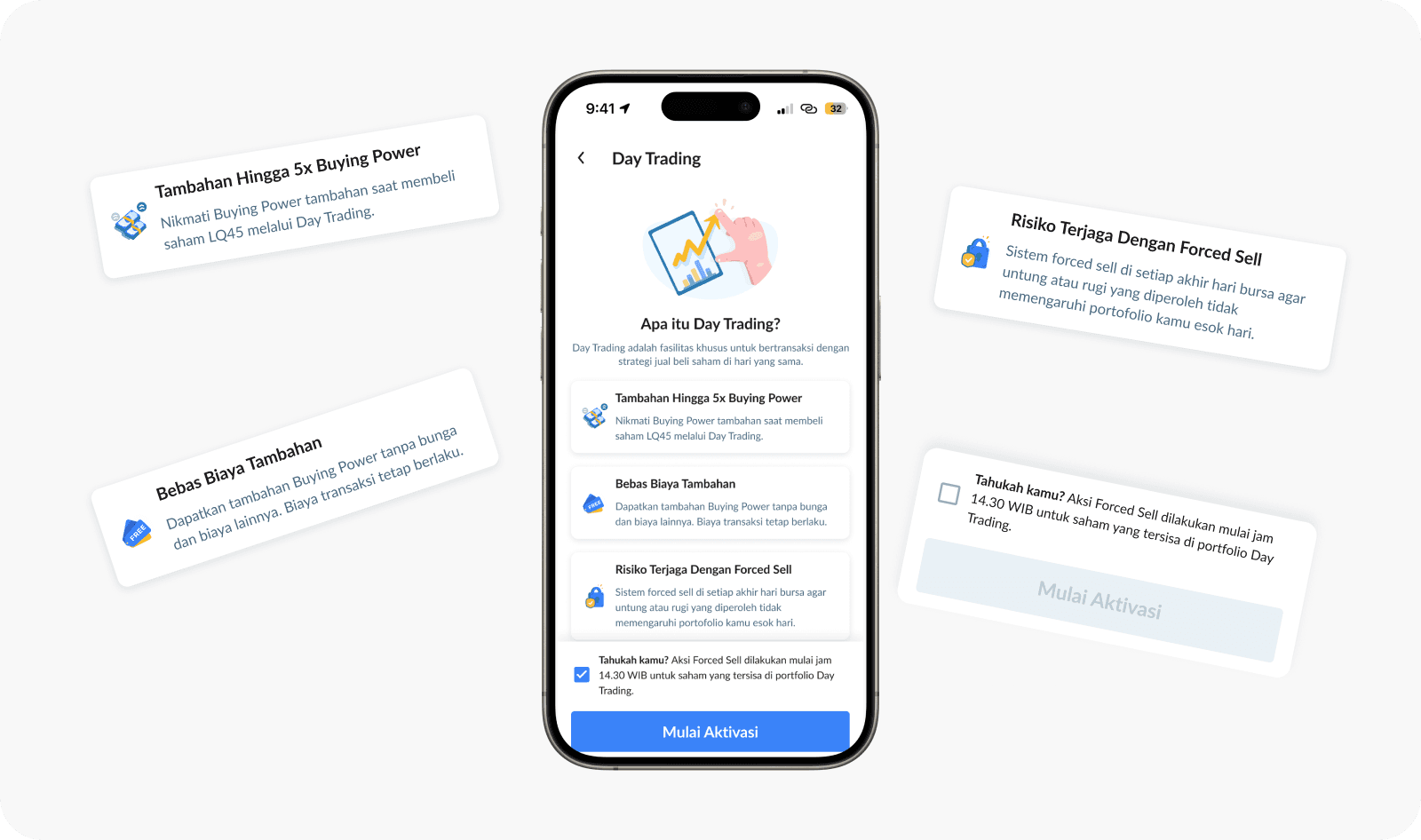

Only 25% of our users finished onboarding and were fully eligible for using day trading.

While 87% of our users who actually finished onboarding are using this feature daily.

Onboarding information is unclear.

We haven't rolled out this feature to more users.

We used the copy "Forced sell," which alarmed the users.

75.5% adoption rate after release.

Quarterly daily trading volume goals achieved only in 2 months.

Rolled out to 100% of users in 1.5 months because of the positive feedback (originally, we wanted to see the results in 1 quarter before assessing them).